Are you looking to make the most out of your homeowners insurance coverage? Look no further! In this article, we will unveil insider secrets to help you maximize the benefits of your policy and ensure you have the protection you need for your home sweet home. It’s important to note that while homeowners insurance is our focus here, we will also touch upon its correlation with car and auto insurance. So, let’s dive right into the depths of homeowners insurance and discover some valuable tips and tricks to make it work for you!

Understanding Homeowners Insurance

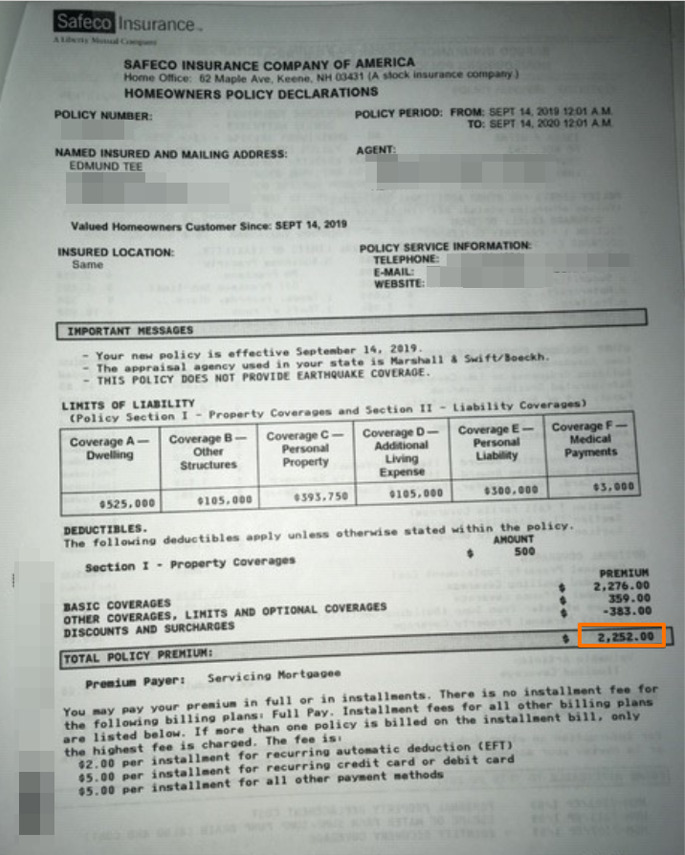

When it comes to protecting your most valuable asset, homeowners insurance is an essential investment. This type of insurance coverage provides financial protection in the event of damage to your home or personal property. Whether it’s due to a natural disaster, theft, or accidents that occur within your property, homeowners insurance offers peace of mind and a safety net.

In addition to safeguarding your home, homeowners insurance often extends coverage beyond just the physical structure. It can also protect your personal belongings such as furniture, electronics, and appliances. So, if your possessions are damaged, destroyed, or stolen, you can rely on your insurance policy to help replace them.

While homeowners insurance primarily focuses on the protection of your home and personal property, it can also provide liability coverage. This means that if someone is injured while on your property, your insurance can help cover medical expenses, legal fees, and even damages awarded in a lawsuit, if necessary. This can be particularly important as accidents can happen, and being prepared for the unexpected is crucial.

By understanding the fundamentals of homeowners insurance, you can ensure that you have the right coverage to meet your specific needs. Consider comparing different insurance providers and policies to find the one that offers the best value and comprehensive protection for your home and belongings. Don’t overlook the importance of homeowners insurance as it can make a significant difference when it comes to recovering from unexpected events and providing peace of mind for you and your family.

Maximizing Car Insurance Coverage

- Best Homeowners Insurance In Michigan

Increase Liability Limits: One of the key ways to maximize your car insurance coverage is to increase your liability limits. By doing so, you ensure that you are financially protected in the event of an accident where you are at fault. Higher liability limits provide you with added peace of mind and can help cover the costs of property damage and medical expenses for others involved in the accident.

-

Consider Comprehensive and Collision Coverage: When it comes to car insurance, it’s important to think beyond just liability coverage. Comprehensive and collision coverage can provide additional protection for your own vehicle. Comprehensive coverage helps cover damages caused by non-collision incidents, such as theft, vandalism, or damage from natural disasters. Collision coverage, on the other hand, helps cover the cost of repairs or replacement if your vehicle is damaged in a collision.

-

Explore Additional Insurance Options: In addition to car insurance, it’s worth exploring other insurance options that can complement your coverage. For example, some insurance companies offer umbrella policies that provide additional liability coverage beyond your car insurance limits. This can be beneficial if you own significant assets that you want to protect in case of a lawsuit. Additionally, bundling your car insurance with other policies, such as homeowners insurance, can often result in discounts and overall cost savings.

By considering these strategies, you can maximize your car insurance coverage and ensure that you have the necessary protection in place for any unexpected incidents on the road.

Tips for Getting the Best Auto Insurance

When it comes to obtaining the best auto insurance coverage, there are a few key tips to keep in mind. Firstly, it’s important to shop around and compare different insurance providers before making a decision. This allows you to evaluate the various options available to you and select the one that suits your needs and budget the best. Additionally, consider seeking recommendations from friends or family members who have had positive experiences with their auto insurance.

Another valuable tip is to review your current homeowners insurance policy, as some providers offer discounts for bundling home and auto insurance together. Consolidating your insurance policies can potentially save you money while still ensuring comprehensive coverage for both your home and your vehicle.

Lastly, it’s crucial to be aware of the factors that can affect your auto insurance premiums. Maintaining a good driving record and avoiding traffic violations can contribute to lower insurance rates. Additionally, having a safe and secure parking space or garage for your vehicle can also be advantageous. These factors are taken into consideration by insurance providers when determining your premium, so it’s essential to prioritize responsible driving practices and vehicle security.

By following these tips, you can increase your chances of finding the best auto insurance coverage for your needs, potentially save money, and achieve peace of mind knowing that you are well-protected on the road.