When it comes to protecting your investments and assets, insurance is an essential consideration. While many individuals are familiar with home insurance and general liability insurance, there is one type of coverage that often remains shrouded in mystery: bonds insurance. Whether you’re a homeowner looking to hire a contractor, a business owner seeking to secure a project, or a contractor aiming to fulfill contractual obligations, understanding the intricacies of bonds insurance can be a game-changer. In this article, we will demystify bonds insurance, explaining everything you need to know about this specialized form of coverage. From its role in safeguarding construction projects to its connection to contractor insurance and workers’ comp coverage, we will navigate the ins and outs of bonds insurance to ensure you have all the information necessary to make informed decisions. So, let’s delve into the world of bonds insurance and uncover how it can provide you with the peace of mind you deserve.

Understanding Different Types of Insurance

Home Insurance:

Home insurance protects homeowners against financial losses that may occur due to damages or losses to their property. It typically covers damages caused by fire, theft, natural disasters, and other perils. Home insurance policies differ in coverage and can also include liability protection in case someone is injured on the property.

Contractor Insurance:

Home Insurance Michigan

Contractor insurance is vital for professionals in the construction industry. It provides coverage for contractors, subcontractors, builders, and other construction-related professionals. This type of insurance typically includes general liability coverage to protect against property damage or injuries caused by the contractor or their employees during a construction project.

General Liability Insurance:

General liability insurance is essential for businesses as it provides coverage for claims of third-party bodily injury, property damage, or personal injury. It protects businesses against lawsuits or legal expenses arising from accidents or negligence that occur on their premises or as a result of their business operations.

Bonds Insurance:

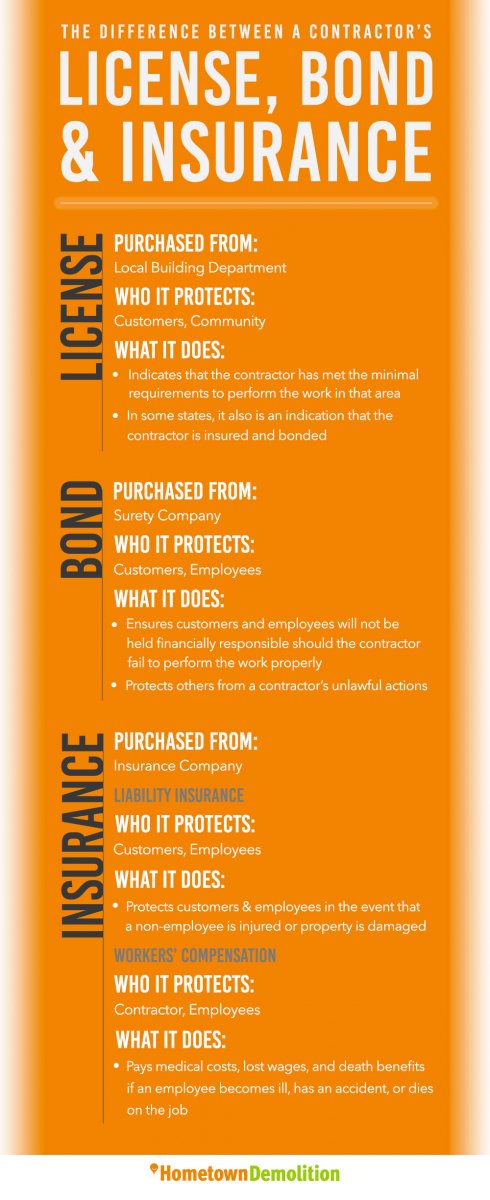

Bonds insurance, also known as surety insurance, protects against financial losses resulting from a breach of contract. It provides a guarantee that the bonded party will fulfill their obligations as stated in the contract, or it will cover the financial losses incurred by the non-breaching party. Bonds insurance is commonly used in construction projects, governmental contracts, and other business agreements.

Workers Comp Insurance:

Workers comp insurance is a crucial coverage for employers as it provides benefits to employees who suffer work-related injuries or illnesses. It covers medical expenses, rehabilitation costs, and lost wages for employees who are injured or become ill due to their job. Workers comp insurance helps protect both employees and employers by providing financial support during challenging times.

Exploring the Importance of Bonds Insurance

Bonds insurance plays a crucial role in safeguarding the interests of various parties involved in different projects. Whether you are a homeowner, a contractor, or a business owner, understanding the importance of bonds insurance is essential. Bonds insurance provides financial protection and reassurance to those undertaking projects, ensuring that potential risks and uncertainties are mitigated effectively.

For homeowners, bonds insurance offers peace of mind when embarking on significant projects such as home renovations or constructions. By requiring contractors to have bonds insurance, homeowners can rest assured that they are protected from financial loss caused by incomplete or unsatisfactory work. In the unfortunate event that a contractor fails to meet their contractual obligations, bonds insurance can provide compensation to the homeowner, enabling them to rectify any deficiencies without incurring additional costs.

Contractors, on the other hand, benefit greatly from bonds insurance as it enhances their credibility and trustworthiness. Having bonds insurance in place demonstrates to clients that the contractor is dedicated to delivering high-quality work and is financially stable. This can significantly improve their chances of securing projects and building a solid reputation in the industry. Moreover, bonds insurance provides a safety net for contractors by offering financial protection against potential claims that may arise due to accidents, property damage, or failure to meet contractual obligations.

General liability insurance, workers comp insurance, and bonds insurance work together to provide comprehensive coverage for businesses. While general liability insurance protects against third-party claims for bodily injury or property damage, workers comp insurance covers employee injuries and medical expenses. Bonds insurance acts as an additional layer of protection by ensuring that projects are completed as agreed upon. This combination of insurance coverage can shield businesses from unexpected financial burdens, lawsuits, and reputational damage.

In summary, bonds insurance is vital for homeowners, contractors, and businesses alike. It offers protection against a range of potential risks while promoting trust and confidence in the industry. By understanding the significance of bonds insurance, individuals and businesses can make informed decisions to mitigate potential liabilities and ensure the successful completion of their projects.

Benefits of Bonds Insurance for Homeowners and Contractors

Bonds insurance offers valuable protection for both homeowners and contractors. It serves as a safety net, ensuring that any unexpected incidents or issues that may arise during a construction project are covered financially.

For homeowners, bonds insurance provides peace of mind. It guarantees that if a contractor fails to complete a project as agreed or fails to meet the necessary quality standards, the homeowner will be compensated. This protection is especially crucial when dealing with large-scale projects, where substantial financial investments are involved.

Additionally, bonds insurance gives homeowners the confidence to hire contractors who are bonded. This certification denotes that the contractor has undergone rigorous screening and meets certain standards of professionalism and reliability. It acts as a seal of trust, assuring the homeowner that they are hiring a reputable individual or company.

Contractors also benefit greatly from bonds insurance. It helps to build their credibility in the industry, making them more appealing to potential clients. Being bonded shows that they take their work seriously and are financially responsible, which can give them a competitive edge when bidding on projects. This insurance coverage also protects contractors from potential legal disputes, as it provides a source of funds to cover any damages or losses incurred by the client.

In summary, bonds insurance offers significant advantages for both homeowners and contractors. It provides financial protection and peace of mind for homeowners while enhancing the credibility and competitiveness of contractors. By understanding the benefits of bonds insurance, homeowners and contractors can make informed decisions and ensure the success and security of their construction projects.